Navigating the world of self-employment is rewarding but comes with its unique challenges, particularly the lack of traditional employee benefits like sick pay. This is where self-employed income protection becomes crucial

Understanding Self-Employed Income Protection

Self-employed income protection insurance provides a financial safety net by offering regular, tax-free payments if you are unable to work due to illness or injury. Typically, these policies cover between 50% and 70% of your average income, ensuring you can manage essential expenses like rent, bills, and mortgage payments

Importance of Income Protection for the Self-Employed

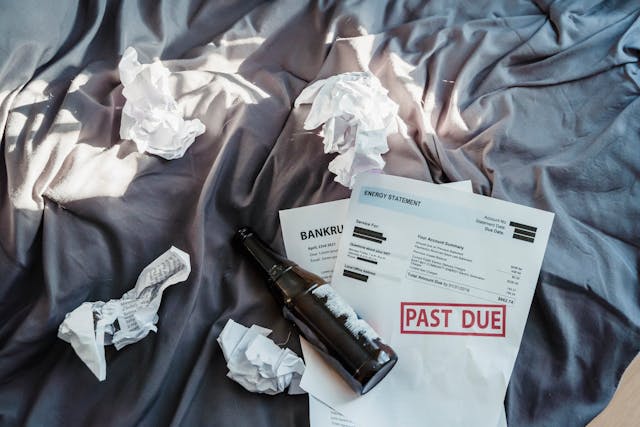

1.Lack of Sick Pay: Unlike salaried employees, self-employed individuals do not receive sick pay. Income protection ensures you have a steady income stream during periods of illness or injury.

2. Financial Stability: This insurance helps maintain financial stability by covering core monthly outgoings, reducing the need to dip into savings or rely solely on government benefits, which are often insufficient.

3. Peace of Mind: Knowing that your income is protected allows you to focus on recovery without the added stress of financial burdens

How Self-Employed Income Protection Works

Income protection policies for the self-employed function similarly to standard policies. You pay a monthly premium based on factors such as age, health, lifestyle, and the level of coverage desired. In return, if you need to claim, the policy pays out a regular income until you can return to work or reach retirement age.

Key Considerations

Policy Duration: Policies can be short-term (up to 12 months) or long-term (until retirement). Your choice depends on personal circumstances and financial needs.

Deferral Period: This is the waiting period before payments begin after a claim is made. A longer deferral period usually results in lower premiums.

Coverage Limits: Most policies cover up to 70% of your gross income. It’s crucial to calculate your monthly expenses accurately to determine the appropriate level of coverage.

Benefits Over Other Insurance Types

Unlike critical illness or life insurance, which provide lump-sum payouts for severe conditions or death, income protection offers ongoing support for everyday expenses during temporary health challenges.

Tying up the facts, for self-employed individuals in the UK, income protection insurance is not just a luxury but a necessity. It offers peace of mind and financial security in times of illness or injury, allowing you to focus on what truly matters—your health and well-being. By understanding and investing in the right policy, you can safeguard your future and ensure that being your own boss remains as rewarding as it should be.

Citations:[1] Income Protection for Self-Employed People Guide – Vitality https://www.vitality.co.uk/life-insurance/guides/income-protection-for-self-employed-people/

[2] Self-employed Income Protection | Compare Quotes – ActiveQuote https://www.activequote.com/income-protection/self-employed/

[3] Income Protection for Self-Employed [Quotes from 20p-a-day] https://www.reassured.co.uk/income-protection/income-protection-for-self-employed/

[4] Self Employed Income Protection / Compare Best UK Quotes 2024 https://www.drewberryinsurance.co.uk/income-protection-insurance/self-employed-income-protection

[5] Self-employed income protection: the facts – Aviva https://www.aviva.co.uk/insurance/life-products/income-protection-insurance/knowledge-centre/self-employed-income-protection/

[6] Personal insurance when you’re self-employed | MoneyHelper https://www.moneyhelper.org.uk/en/work/self-employment/personal-insurance-when-self-employed

[7] Self Employed Income Protection – Compare the Market https://www.comparethemarket.com/life-insurance/content/self-employed-income-protection/

[8] Compare Income Protection Insurance | GoCompare https://www.gocompare.com/income-protection/

Leave a Reply